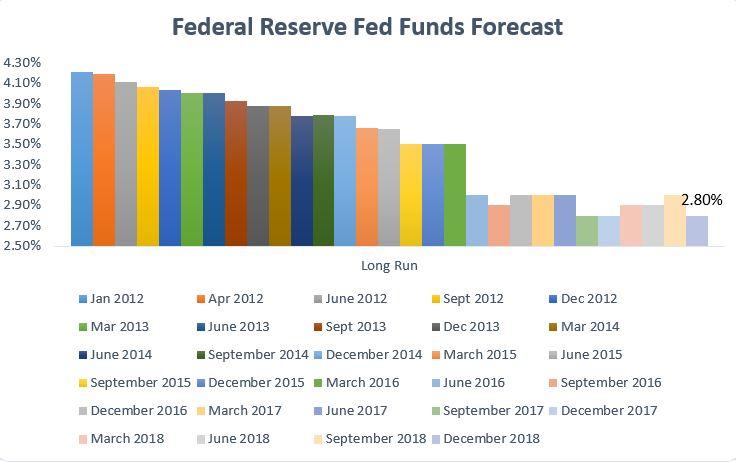

Much of the talk about inflation still revolves around a “supply” shock that will go away on its own. Various Fed speeches and commentary I have read do not shed much light on this question. Expected inflation is higher, just not so much as past inflation real rates measured by nominal rates less expected future inflation remain negative throughout until we return to the long-term trend.īy any measure, in these projections real rates remain negative, yet inflation dies away all on its own. But the Fed’s projections do not defend that view either. So we might excuse the Fed’s inaction by its belief that inflation will melt away on its own, and its view that everyone else agrees. In fact, the real interest rate is the nominal interest rate less expected future inflation. The Fed believes inflation will almost entirely disappear on its own, without the need for any period of high real interest rates.Īn astute reader will notice that above I referred to the “real” interest rate as the nominal interest rate less current inflation. The Fed’s “actual” is end of 2021 quarterly personal consumption expenditures inflation, 5.5 percent.)Īs you can see, this forecast scenario is dramatically different from a repetition of 1980. The Fed’s forecasts for the next year, taken from its March 16 projections, are below. You have to repeat that painful experience, conventional wisdom goes, to squash inflation. Only in 19, when the interest rate rose substantially above inflation and stayed there, did inflation decline. A one-to-one pace keeps the real rate constant, but does not raise real rates as inflation rises.

The conventional story is that the 1970s one-to-one response was not enough. And that Fed had unemployment on which to blame a slow response. Today’s Fed is much, much slower to act than the reviled inflationary Fed of the 1970s. Interest rates rose just ahead of inflation in 1974, and close to one to one with inflation from 1977 to 1980. Not even in the 1970s did the Fed wait a whole year to do anything. In each spurt of inflation in the 1970s, the Fed did, promptly, raise interest rates, about one for one with inflation. The Fed’s current inaction is even more curious if we look at a longer history. Instead, the event sparked the whole shift to the Fed’s current explicit wait-and-see policies. The Fed has never before been shy about “but for us things would have been much worse” self-congratulation. I would expect a self-interested institution to loudly proclaim success: it raised rates on fear of inflation to come, just enough to keep inflation right at target without starting a recession. The Fed seems to regard it as a big failure-it raised rates on fear of inflation to come, and inflation did not come. Fear of high unemployment does not explain the Fed’s much slower response. March 2022 unemployment is 3.6 percent, lower than it has been since December 1969. Inflation batted around the Fed’s 2 percent target.

In early 2017, unemployment got below 5 percent, inflation got up to and just barely breached the Fed’s 2 percent target, and the Fed promptly started raising interest rates. This reaction is also unusually slow by historical precedent.

Yet the Fed sits, and contemplates at most a percent or two by the end of the year. That means an interest rate of around 12 percent.

#When the fed lowers the discount rate it makes it plus

The Taylor rule says the interest rate should be 2 percent (the Fed’s inflation target), plus 1.5 times how much inflation exceeds 2 percent, plus the long-term real rate. In that way, the real interest rate rises, cooling the economy.Īt a minimum, then, according to the usual wisdom, the interest rate should be above 8.5 percent. The usual wisdom says that to reduce inflation, the Fed must raise the nominal interest rate by more than the inflation rate. On March 15, the Federal Reserve finally budged the federal funds rate from 0 to 0.33 percent, with slow rate rises to come.Ī third of a percent is a lot less than 8.5 percent. It was 8.5 percent in March and trending up. Inflation has been with the United States for a year.

0 kommentar(er)

0 kommentar(er)